The World Bank’s “Doing Business” reports assess the ease of doing business in different countries, by comparing policies and regulation. It is a fascinating exercise, but one which is based upon an implicit assumption that these rules matter, and that they are binding.

A new NBER working paper by Mary Hallward-Driemeier, Gita Khun-Jush, and Lant Pritchett argues that in Africa, policies and regulations are typically not very well implemented, meaning that deals are more important to firms than rules.

We argue that often firms in Africa do not cope with policy rules, rather they face deals; firm-specific policy actions that can be influenced by firm actions (e.g. bribes) and characteristics (e.g. political connections). Using Enterprise Survey data we demonstrate huge variability in reported policy actions across firms notionally facing the same policy. The within-country dispersion in firm-specific policy actions is larger than the cross-national differences in average policy … Finally, we show that the de jure measures such as Doing Business indicators are virtually uncorrelated with ex-post firm-level responses, further evidence that deals rather than rules prevail in Africa.

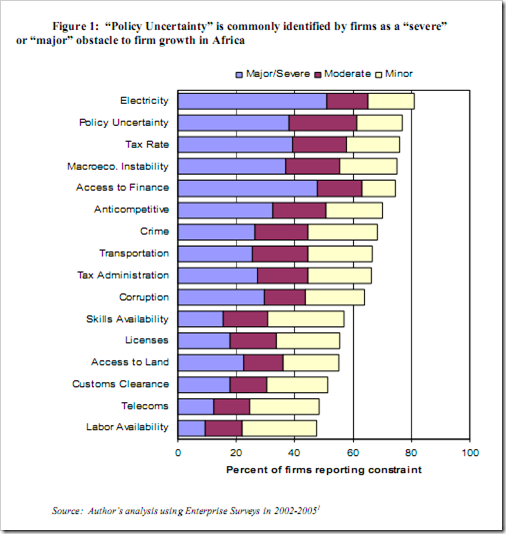

The constraints reported by 3317 firms in 13 countries are shown in the Figure below. The point being made is that policy uncertainty is much more important than licences or customs clearance, but I am also pretty stunned by the reported importance of electricity.