"An effective tax policy that ensures adequate domestic revenue is a crucial determinant of a country’s ability to pursue development policies. But tax revenues in most developing countries are low, impeding progress toward more balanced, inclusive, and sustainable economic development that can improve public health and raise standards of living." -- Jomo Kwame SundaramGenuine question - is there actually a good reason that I am just unaware of that the UN shouldn't pay tax?

25 February 2025

Tax and development hypocrisy watch

18 January 2025

Aid and tax dodging

Scott Gilmore has a great article discussing the absurdity of the UN, donors, and their contractors operating tax-free in developing countries. We even pay advisors to go to developing countries to help them improve their systems of taxation, whilst these very same advisors are getting paid tax-free, helping to undermine those systems. Apparently the irony is lost.

#Stuffexpataidworkerslike: Tax-Dodging.

03 June 2025

Constraints to medium-sized firm growth

The World Bank’s “Doing Business” reports assess the ease of doing business in different countries, by comparing policies and regulation. It is a fascinating exercise, but one which is based upon an implicit assumption that these rules matter, and that they are binding.

A new NBER working paper by Mary Hallward-Driemeier, Gita Khun-Jush, and Lant Pritchett argues that in Africa, policies and regulations are typically not very well implemented, meaning that deals are more important to firms than rules.

We argue that often firms in Africa do not cope with policy rules, rather they face deals; firm-specific policy actions that can be influenced by firm actions (e.g. bribes) and characteristics (e.g. political connections). Using Enterprise Survey data we demonstrate huge variability in reported policy actions across firms notionally facing the same policy. The within-country dispersion in firm-specific policy actions is larger than the cross-national differences in average policy … Finally, we show that the de jure measures such as Doing Business indicators are virtually uncorrelated with ex-post firm-level responses, further evidence that deals rather than rules prevail in Africa.

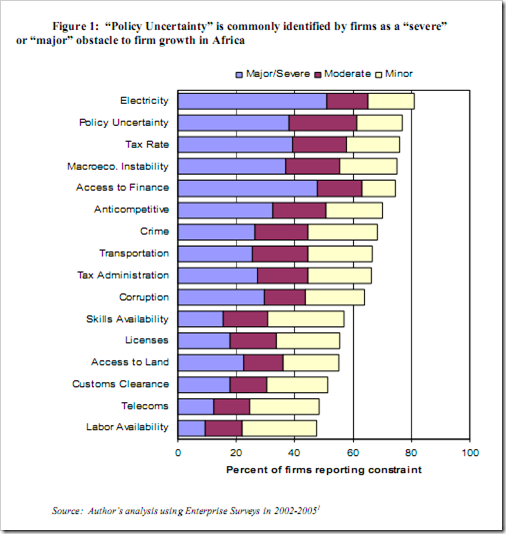

The constraints reported by 3317 firms in 13 countries are shown in the Figure below. The point being made is that policy uncertainty is much more important than licences or customs clearance, but I am also pretty stunned by the reported importance of electricity.

28 May 2025

Why don’t aid workers pay tax?

Independent of these arguments - a good tax system is inherently a good thing: providing predictable funding for the government and a bit more accountability.

So why doesn’t the international community do more to support these systems directly by putting their (overpaid?) salaries through them? Hey donors - we’re giving aid anyway, does it really matter if some of it goes into developing country government coffers in a good way? Wouldn’t the increased volumes create demand for a better, more efficient tax system? Is it only Southern Sudan where the entire international community is exempt from paying any income tax?

28 April 2025

Jigy Jigy

A solution to the budget crisis from a friend at UNDP. Go Dutch and start taxing the East African "unmarried business women" who are undercutting the locals for "Jigy Jigy."

Pity the poor "undercover" journalists who wrote this piece.

My friend also suggests we might need some "hookers without borders" to advise these ladies on their pricing strategies. $5 for one ejaculation and $10 for the whole night!